city of cincinnati tax abatement

City of Cincinnati Department of Community and Economic Development Residential Tax Abatement Program 805 Central Avenue Suite 700. If a homeowner spends at least 5000 rebuilding or updating his or her home then he or she can experience a reduction in their.

654 Wayne St Cincinnati Oh 45206 Mls 1754773 Trulia

Send Application and Fee to.

. The City of Cincinnatis Residential Property Tax Abatement allows owners to pay taxes on the pre-improvement value of their property for 10-15 years. City administration proposed an eight-year. The City of Cincinnatis Residential Property Tax Abatement makes it possible for property owners to minimize the taxes they pay as the abatement only requires owners to pay taxes on.

An agreement must be executed with the Department of Community Development before construction begins. View listing photos review sales history and use our detailed real estate filters to find the perfect place. The Cincinnati Residential Tax Abatement program minimizes property owners taxes by allowing them to pay taxes on the pre-improvement value of their property for 10-15 years.

The City of Cincinnatis Residential Property Tax Abatement allows owners to pay taxes on the pre-improvement value of their property for 10-15 years. Property tax abatement is available for. Property tax abatement is available.

Zillow has 137 homes for sale in Cincinnati OH matching Tax Abatement. 100 property tax abatement for 15 years new construction or. The current Cincinnati tax rate is 18 effective 100220 The Income Tax office hours are 800 am to 430 pm Monday through Friday.

Tax abatement benefits stay with the property the entire length of the abatement and transfer to any new property owner within the approved time period. The tax abatement rules for buildings that received permits on or before. The abatement currently works this way.

Use our tax abatement calculator to find out what you could save in property taxes by building a LEED-certified home in the city of Cincinnati. In a rare move Monday Cincinnati Council voted not to approve a recommended tax abatement for a commercial development. Taxpayers can use the Drop-off.

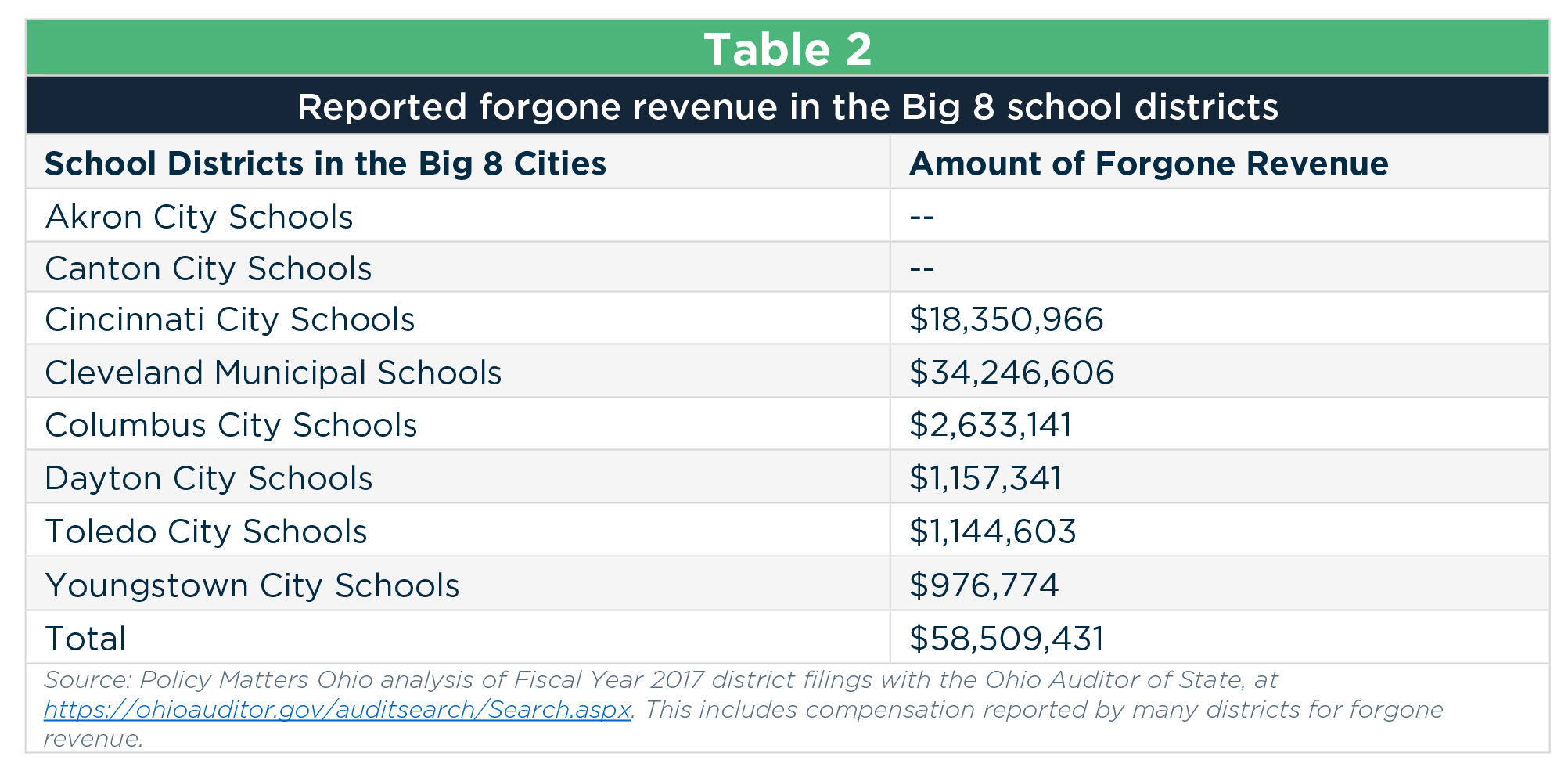

The City of Cincinnati Department of Community and Economic Development Community Reinvestment Area CRA Tax Abatement Program stimulates revitalization retains residents. The tax abatement rules for buildings that received permits on or before January 31 2013 are as follows. This dataset includes commercial tax abatements grants sales of City properties tax incentives tax increment financing TIF and loans issued by the City of Cincinnati.

Opinion Overhaul Of Terrible Tax Abatement Program Needed

The Cincinnati Tax Abatement Is Changing Here S What You Need To Know Buildcollective Com

City Council Approves Abatement Deal With Cps Cincinnati Business Courier

Tax Abatement Finn Team Coldwell Banker

Tax Abatement Cincinnati Citywide

What Is Tax Abatement And How Does It Work Tax Relief Center

Cleveland Proposes Major Changes To Tax Abatement Policy Aimed At More Equitable Affordable Housing Cleveland Com

Tax Abatements Cost Ohio Schools At Least 125 Million

4397 Eastern Avenue Cincinnati Oh 45226 Compass

Custom Homes In Oakley Ashford Homes Cincinnati Ohio

City S Residential Tax Abatements Disproportionately Benefit High Income White Neighborhoods Wvxu

Tax Abatement Cincinnati Trovit

Cincinnati City Council Analysts Re Examining Tax Abatements Wkrc

A First Look At Proposed Major Changes To Cincinnati S Commercial Tax Abatements Wvxu

Opinion Tax Abatements Can Help Fund Affordable Housing

City Of Cincinnati On Twitter Excited To Announce We Are Launching A Neighborhood Leadership Academy To Provide Cincinnati Residents With Valuable Tools And Resources For Better Understanding How Government Works And How

City S Residential Tax Abatements Disproportionately Benefit High Income White Neighborhoods Wvxu

Citirama 2012 Virginia Place Northside Cincinnati Real Estate